Monday, December 1

Trades Taken

Sold bar 68 and sold again at bar 91. Lost both trades on bar 94 as the price went up for about a measured move based on the height of the [local] trading range.

Trades Not Taken

A short could have been entered on bar 99. It was the third push of a wedge that formed on top of the preceding wedge at a measured move target.

Tuesday, December 2

Trades Taken

Bought bar 58 and sold bar 65 (not sure if my stop got hit or if I got scared and sold at market). Whatever the case, I bought again soon afterwards at bar 67 but only held until bar 85.

Trades Not Taken

There was a major trend reversal setup around bar 52 and a higher low major trend reversal off a double bottom (after a moving average gap bar) around bar 84.

Wednesday, December 3

Trades Taken

Shorted around bar 81 as the price went about a measured move projection based on the height of the bar 44 spike. The bar 100 high approached my stop loss but ultimately turned back down and the price collapsed into my take profit (based off the bar 48 close).

Trades Not Taken

Nothing noteworthy. You maybe could have convinced yourself to short for a major trend reversal after the bar 100 climactic price action, but without a moving average gap bar it seemed a bit hard to justify.

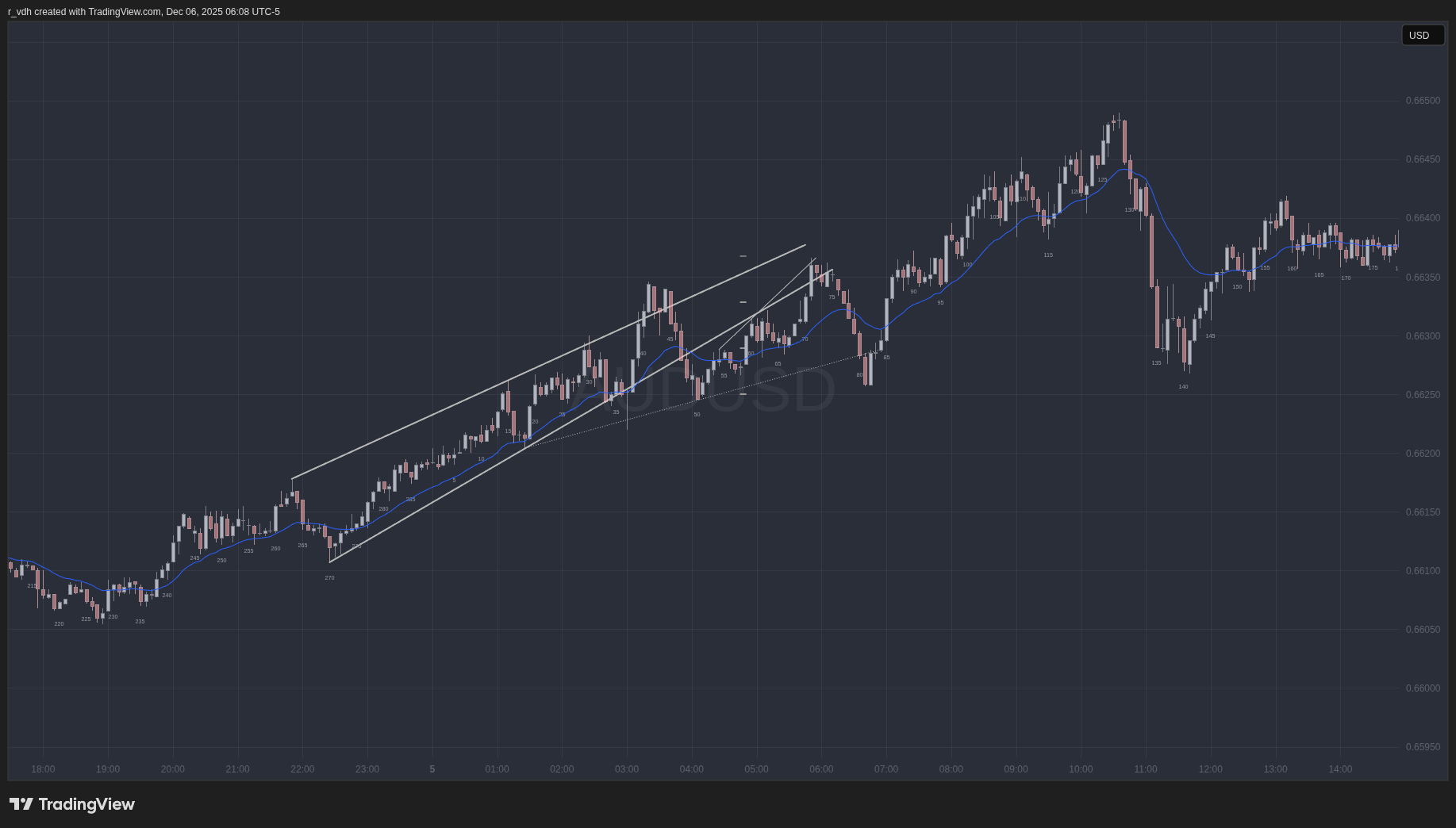

Thursday, December 4

Trades Taken

Entered long around the bar 52 close. Stop loss was below the bar 269 low, but after continuing downward with the major trend reversal I adjusted the take profit to break even which executed around bar 110.

Trades Not Taken

After the bar 48 trend line break and the bar 49 moving average gap bar, the correction up was a setup for a major trend reversal short with entry bars at bars 57 and 61.

Even though a lower low was not unlikely (only the second push down since the bar 38 top), entering a long in the bar 74-77 range – with a stop loss below the bar 269 low – was also a good trade. This long could also have been entered anywhere in the trading range that occurred between bars 95 and 108, but most notably on the bar 106 high-3 entry bar.

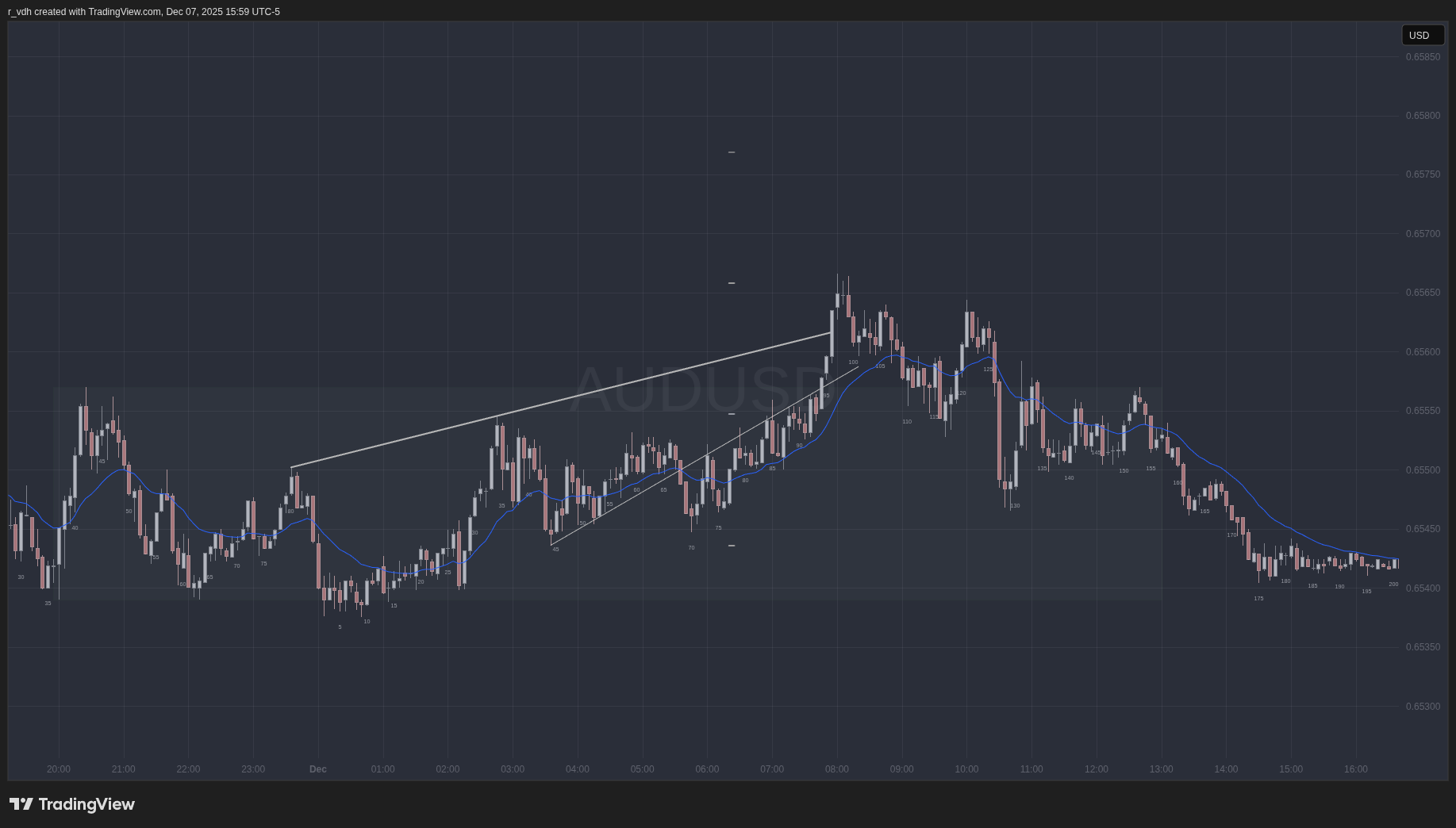

Friday, December 5

Trades Taken

Entered short after the bar 63 low-3 signal bar with a tight stop loss. Got stopped out within the hour on the third push up, but should have exited on the bar 68 high-3 entry, and re-entered the short on either bar 73 or 76.

Trades Not Taken

Low-3 (low-4?) major trend reversal entry bar occurred at bar 73 and there was a second entry at bar 76. Buying bar 84 or bar 85 as it went above the high of the preceding bar was a good entry for a bull continuation trade. Buying the bar 80 close would also be reasonable, given a stop loss below the bar 80 low).